|

|

GLENN MYLES - Wall Street Capital Tycoon by Kaya Morgan

GLENN MYLES - Wall Street Capital Tycoon by Kaya Morgan

Spanning an international career of over 30 years, Glenn Myles has been involved in more than $10 Billion Dollars worth of business transactions as an investor, principle or advisor. As President and CEO, Glenn is the driving force behind the First Wall Street Capital team, a global investment banking firm whose focus is on a wide variety of projects from energy, entertainment and real estate, both in the U.S. and on international projects in London, Paris, Moscow, Puerto Rico, Japan, Bulgaria, Venezuela, Colombia, and Beijing.

Of humble beginnings, Myles grew up living on the water in Brooklyn with his brother and sister, raised by their single mom. After high school, he attended Brooklyn College while working as a taxicab driver to help pay his way through school. A theatre major, he never dreamt of going into the business world but at 22 years old, was offered a movie project starring Muhammad Ali, then at the top of his career, with a budget of $5.5 Million. His job was to find the money, although he had never raised money for anything. Not knowing where to begin, he took out the Yellow Pages and looked up "Motion Pictures." After calling everyone on the list, he secured a few appointments but still could not find anyone interested enough to put up the money — the studios didn't want it and investors didn't believe in it.

As luck would have it , while running to catch a taxicab in the rain in downtown Greenwich Village, he ended up sharing the cab with a beautiful, young African-American woman who was heading the same direction as he — in more ways than one. As they began to make small talk in the cab, as luck would have it, she was the girlfriend of the Ambassador from Kenya to the United Nations. Myles and Ali's attorney flew to Kenya to negotiate the deal. The Kenyan Government decided to put up half of the money for the film and still, Myles could not convince Hollywood to cover the other half.

As luck would have it , while running to catch a taxicab in the rain in downtown Greenwich Village, he ended up sharing the cab with a beautiful, young African-American woman who was heading the same direction as he — in more ways than one. As they began to make small talk in the cab, as luck would have it, she was the girlfriend of the Ambassador from Kenya to the United Nations. Myles and Ali's attorney flew to Kenya to negotiate the deal. The Kenyan Government decided to put up half of the money for the film and still, Myles could not convince Hollywood to cover the other half.

"Although that film was never made, it was a very good lesson for my future growth as a businessman. From that experience, I decided that if money were only going to change my life slightly, I'd rather be on the giving side than having to beg for it. So, I've devoted the rest of my life to using my creative skills to provide sources of capital for entrepreneurs, and for my partners," explains Myles.

Having always had high aspirations, somehow, everything he touched was like spinning gold. A natural born fiancier, coupled with a powerful, vibrant, and charming personality, Myles worked his way through various ownership positions in a gamut of diverse businesses from retail, auto parts, finance, shopping centers, hotels, oil drilling, to the music business, movie production and even a professional sports team.

Having always had high aspirations, somehow, everything he touched was like spinning gold. A natural born fiancier, coupled with a powerful, vibrant, and charming personality, Myles worked his way through various ownership positions in a gamut of diverse businesses from retail, auto parts, finance, shopping centers, hotels, oil drilling, to the music business, movie production and even a professional sports team.

There is hardly any sector of business that Myles has not given the Midas touch. Whether it's over seeing the acquisition of 5,000 apartments and the conversion of thousands of cooperatives and condominiums, to the re-acquisition of Canary Wharf in London, or advising Nomura Securities on their bid for FGH Bank, his expertise continues to be in high demand. Recently, he restructured $236 Million for the Hard Rock Hotel & Casino in Biloxi (Mississippi), raising €100 Million for a Bulgarian developer through a multi-billion dollar hedge fund, or creating the first "green" publicly traded development corporation devoted to sustainable businesses such as recycling and renewable energy companies.

Myles has also made personal investments in Royce Union Bicycles, Times Square Stores, the Ritz Carlton Hotel in Puerto Rico, a chain of women's specialty stores, Finders-Keepers, as well as owning Wilcox International that procured goods and merchandise from China and Hong Kong for sale through his retail chain. In addition, he was a shareholder of Hulk Hogan Vitamins, the Solaris Marketing Group, and has sat on various Boards including the Fairchild Corporation, Planet Finance and others.

Glenn has had substantial experience in both the financial and the entertainment world as former Executive Vice President of the Davis Corporation, a holding company with diverse and extensive business operations that included oil and gas exploration, real estate, the Aspen Ski Company, and Davis Entertainment. He reported directly to billionaire Marvin Davis — former owner of 20th Century Fox, the Beverly Hills Hotel and Pebble Beach. Somehow, Myles always felt that it was more important to have the people he worked with receive the publicity, preferring to keep a low profile himself.

In his leisure hours, Glenn loves a good game of tennis. With a tennis-pro brother, he never really aspired to reach that level of expertise and considers himself just a "B" player. Having previously owned interests in several racehorses, Myles greatly enjoys showing and riding his quarter horses, a Palomino and an Appaloosa, through the Long Island countryside. "Now I know why Ronald Reagan spent so much time riding. You're out on the trail for several hours with quiet time to just think. In my business, it's high stress, 24/7. There's always a partner that needs your time, a deal that needs your attention. There's always a structure that goes wrong in the transaction. To simply be out riding in nature is a great stress reliever," sighs Glenn. "I try to spend as much time with them as I can."

In his leisure hours, Glenn loves a good game of tennis. With a tennis-pro brother, he never really aspired to reach that level of expertise and considers himself just a "B" player. Having previously owned interests in several racehorses, Myles greatly enjoys showing and riding his quarter horses, a Palomino and an Appaloosa, through the Long Island countryside. "Now I know why Ronald Reagan spent so much time riding. You're out on the trail for several hours with quiet time to just think. In my business, it's high stress, 24/7. There's always a partner that needs your time, a deal that needs your attention. There's always a structure that goes wrong in the transaction. To simply be out riding in nature is a great stress reliever," sighs Glenn. "I try to spend as much time with them as I can."

Family is clearly the most important thing to him. When taking a well-deserved break from hectic business schedules, Glenn spends as much time as possible with his two grown sons, Justin and Matt either engaged in a stimulating game of basketball, or out on the tennis court. As time permits, Glenn also loves to spend time riding, boating or simply entertaining friends. When he does travel, Europe is always at the top of his list. Yet, sports is also one of Myles' greatest passions and favorite pastimes with season's tickets to the New York Nicks always his first choice.

Family is clearly the most important thing to him. When taking a well-deserved break from hectic business schedules, Glenn spends as much time as possible with his two grown sons, Justin and Matt either engaged in a stimulating game of basketball, or out on the tennis court. As time permits, Glenn also loves to spend time riding, boating or simply entertaining friends. When he does travel, Europe is always at the top of his list. Yet, sports is also one of Myles' greatest passions and favorite pastimes with season's tickets to the New York Nicks always his first choice.

Glenn also donates his time and energy to a number of charities including a youth foundation that provides inner city kids with jobs at major corporations like Lehman Brothers, IBM and NBC; a foundation providing grants to Native Americans, and another that provides assistance and training for displaced or out-of-work adults in inner cities. He has also served on the board of Pulitzer Prize winner, Mohammad Yunis' Grameen America, a foundation that combines the power of microfinance with technology that helps fight global poverty in 23 developing countries around the world.

There's little doubt that under Glenn's direction and management, First Wall Street Capital has significantly increased in scope and reach. In addition to his activities in the e-Commerce industry, he has sat on the Board of Fountainhead Communications, a Value Added Network (VAN) that enables the transmission of electronic data to be exchanged via the Internet.

There's little doubt that under Glenn's direction and management, First Wall Street Capital has significantly increased in scope and reach. In addition to his activities in the e-Commerce industry, he has sat on the Board of Fountainhead Communications, a Value Added Network (VAN) that enables the transmission of electronic data to be exchanged via the Internet.

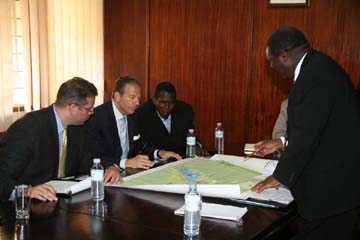

Recently, he led a delegation to Uganda, meeting with President Yoweri Museveni, to discuss plans to encourage foreign investment in the hospitality and services sector. These days, Glenn spends much of his time working with investors and companies in China because he forsees that, "much of the future world economies are tied to development in that region. Through multiple overseas joint ventures, First Wall Street is set to capitalize on those emerging markets."

Asked if he has any regrets, Glenn replies, "Well, there was an old man once, when we were making investments in Atlantic City in the early days, who told us to go to Las Vegas — that it would become the Mecca of the gaming industry! Beyond that, I truly wish for more quality time with my family." Myles believes that, "Certain things are meant to be. You can never really know what lies around the next corner but should always be prepared for anything." That adage, and his commitment to helping others realize their dreams, has indeed served him well.

For more information, go to www.firstwallst.com

All rights reserved © 2010

Press Coverage | VentureCapital | Business Development | Venture Opportunities | Resources | Contact Us | Investor Extras | Home